This week, almost all of Canada’s major banks cut their advertised fixed mortgage rates, some as low as 0.70%.

The cuts applied to all mortgage terms, including 5-year mortgages, with insured borrowers (those with less than 20% down payment) paying an average of 5.24%, and uninsured borrowers paying about 5.65%.

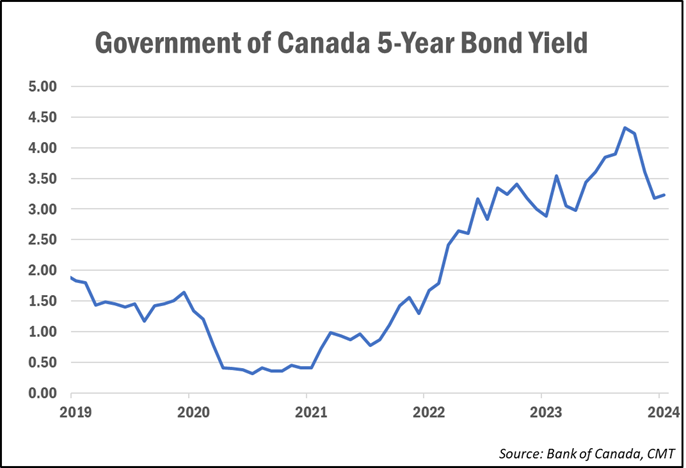

According to reports, well-qualified borrowers at some banks are now being offered high ratio 5-year mortgages starting at 4.99%, as long as they are closing within the next month. Fixed mortgage rates have been on the decline since October, following the drop in G.D.C. bond yields (which are priced based on fixed mortgage rates). Bond yields have fallen more than 1% since the peak in early October, indicating that bond yields are likely to continue to decline in the run-up to inflation.

Variable rates are expected to fall later this year

As the Bank of Canada implements anticipated rate cuts, variable mortgage rates—which are currently priced between 100 and 150 basis points higher than comparable fixed rates—are predicted to decline over the year.

Anyone selecting a variable rate now needs to have faith that it will decrease in comparison to the current fixed rates and that they will have enough remaining time to recover the higher initial cost in addition to some extra savings.

If you are currently applying for a new mortgage and can accept the risk of missing payments and be patient, consider a variable rate. If you are renewing your mortgage and are concerned about payment issues, please choose a 3-year contract period for him to get a more favorable contract.

For any further information or questions, Please feel free to reach out.

RAJVIR GREWAL, REAL ESTATE BROKER

647-676-1700

RE/MAX GOLD.